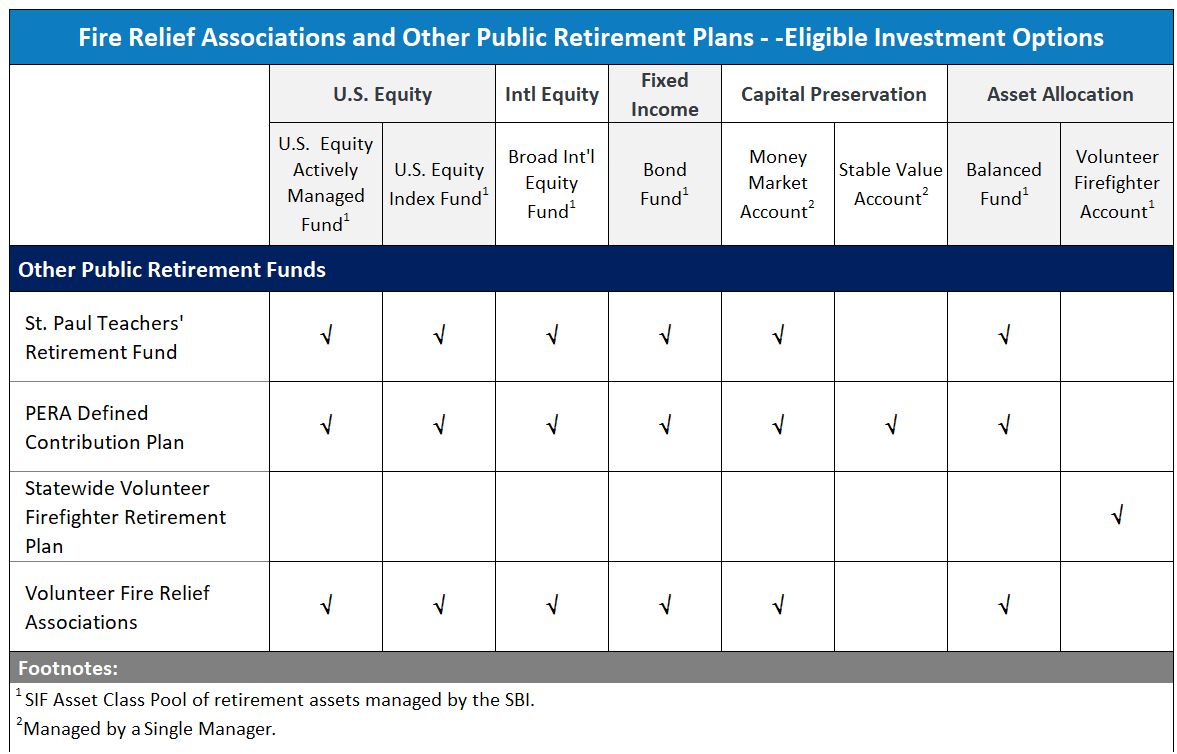

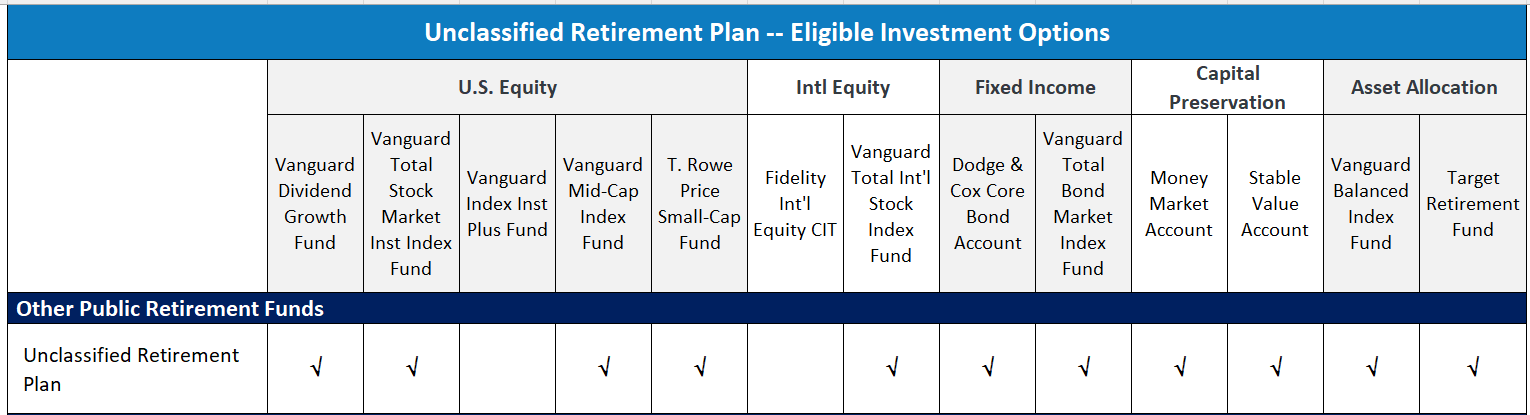

The SBI provides a broad range of investment options to Volunteer Fire Relief Associations and Other Public Retirement Funds. Participating plans include the Statewide Volunteer Firefighter (SVF) Plan, Volunteer Fire Relief Associations, St. Paul Teachers’ Retirement Plan, PERA Defined Contribution Plan, and the Unclassified Retirement Plan.

The investment options available to each plan will vary. Some of the retirement plans invest in one or more of the investment options listed below and make investment decisions at the plan level. There are also retirement plans in this group where the individual participant chooses the investment options that meet their risk and return objectives.

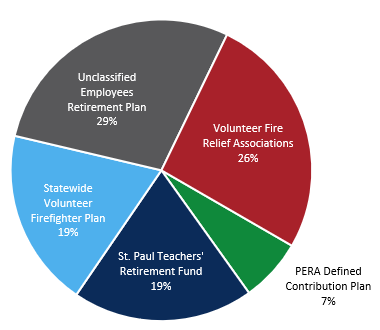

Allocation of assets to Fire Relief Plans + Other Public Retirement Plans as of December 31, 2025

Image

- Volunteer Fire Relief Associations

- Statewide Volunteer Firefighter (SVF) Plan

- St. Paul Teachers' Retirement Fund

- Unclassified Employees Retirement Plan

- PERA Defined Contribution Plan