The Participant Directed Investment Program provides a variety of investment vehicles to state and local public employees for their retirement or other tax-advantaged savings plans and to individuals and families in the State Sponsored Savings Plans.

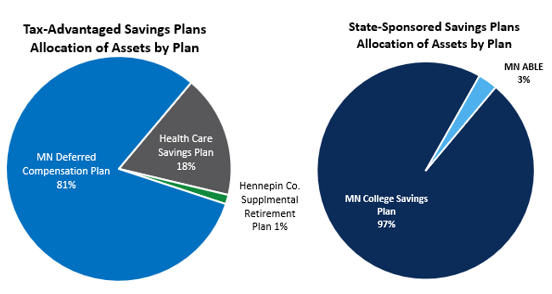

Participant Directed Investments Allocation of Assets by Plan as of December 31, 2025

Image

- Tax-Advantaged Savings Plans

- MN Deferred Compensation Plan

- Health Care Savings Plan

- Hennepin County Supplemental Retirement Plan

- State-Sponsored Savings Plans

- Minnesota ABLE Plan

- Minnesota College Savings Plan

The SBI's objective in its Participant Directed Investment Program, is to offer broad asset class options at low fees that will help participants achieve their savings goals. Participants can allocate their funds among one or more of the investment options that meet the statutory requirements and rules established by the plan.

Investment Vehicles available to Eligible Plans in the Participant Directed Investment Program

| Plans | Mutual Funds | Supplemental Investment Fund | Program Manager | ||

|---|---|---|---|---|---|

| SIF Asset Class Pools | Stable Value Fund | Money Market Fund | |||

| Health Care Savings Plan | |||||

| Hennepin County Supplemental Retirement Plan | |||||

| Minnesota Deferred Compensation Plan | |||||

| Public Employees Retirement Association (PERA) Defined Contribution Plan | |||||

| Unclassified Employees Retirement Plan | |||||

| Minnesota ABLE Plan | |||||

| Minnesota College Savings Plan | |||||