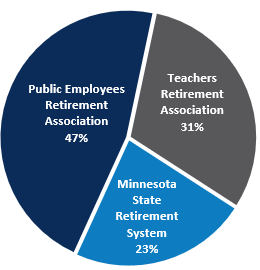

The Combined Funds represent the assets of active and retired public employees in the three statewide retirement systems, which include Minnesota State Retirement System (MSRS), Public Employees Retirement Association (PERA), and Teachers Retirement Association (TRA).

The Combined Funds assets are allocated in public equity (domestic and international), fixed income, and private markets. Each asset class may be further differentiated by geography, management style and/or strategy. This diversification is intended to reduce wide fluctuations in investment returns on a year-to-year basis and enhance the fund’s ability to meet or exceed the actuarial return target over the long-term.

Combined Funds Asset Mix as of 12/31/2025

Private Markets allocation includes invested and uninvested amounts

| Asset Class | Percentage (%) |

|---|---|

| Public Equity | 52.9% |

| Fixed Income | 25.7% |

| Private Markets | 21.5% |

| Private Markets - Invested | 20.6% |

| Private Markets - Uninvested | 0.8% |

| Total | 100% |

Combined Funds Asset Allocation Policy Target

| Asset Class | Percentage (%) |

|---|---|

| Public Equity | 50% |

| Fixed Income | 25% |

| Private Markets | 25% |

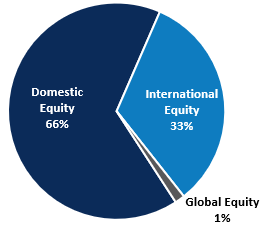

Public Equity Allocation

As of 12/31/2025

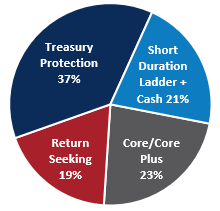

Fixed Income Allocation

As of 12/31/2025

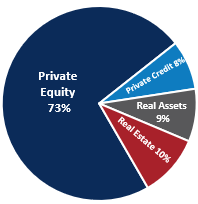

Private Markets Invested Allocation

As of 12/31/2025

The composition of public retirement plans in the Combined Funds as of December 31, 2025