The Minnesota State Board of Investment (SBI) is responsible for the asset management of the five investment programs listed below. Each investment program, managed by the SBI, uses different investment vehicles to help participating plans, entities, and individuals reach their savings goals. By pooling the assets within each program, the SBI can offer institutional investment management at a low cost.

The Combined Funds represents the defined benefit assets for the three Statewide Retirement Systems: Minnesota State Retirement System (MSRS), Public Employees Retirement Association (PERA), and Teachers Retirement Association (TRA).

Fire Relief Plans + Other Public Retirement Plans, consists of the assets for volunteer firefighter relief associations in the State of Minnesota, the Statewide Volunteer Firefighter Plan, and a participating public retirement plan.

Participant Directed Investments consists of the assets of the participants in the tax-advantaged savings plans and state-sponsored savings plans.

Tax-Advantaged Savings Plans: The investment options offered within each plan vary based on several factors, including statutory requirements, operational limitations, and other rules and regulations established for each participating plan.

State-Sponsored Savings Plans: The SBI is responsible for oversight of the investment options in the State-Sponsored Savings Plans but does not directly administer the plans.

The Non-Retirement Program provides investment options to state trust funds and various public sector entities eligible to invest with the SBI.

State Cash Accounts represents the cash balances of more than 400 state agency accounts, which are managed internally by the SBI in a pooled fund or in separately managed accounts, depending on the legal restrictions of the account.

More information on each investment program can be found by clicking on the links above.

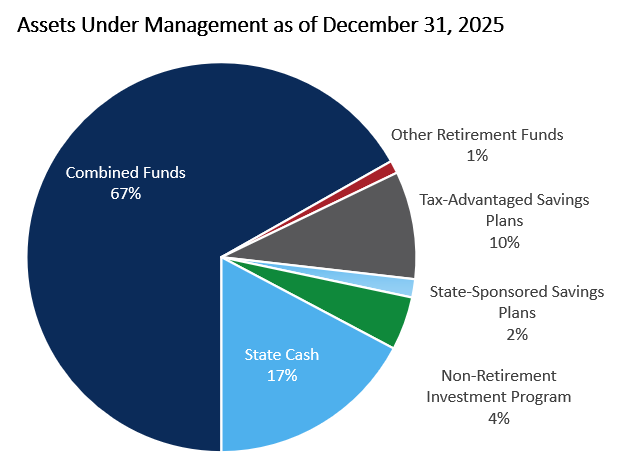

SBI Assets by Investment Program

As of December 31, 2025

| Investment Program | Assets |

|---|---|

| Combined Funds | $107.6 Billion |

| Fire Relief Plans + Other Retirement Funds | $1.7 Billion |

| Tax-Advantaged Savings Plans | $14.4 Billion |

| State-Sponsored Savings Plans | $2.4 Billion |

| Non-Retirement Program | $7.1 Billion |

| State Cash Accounts | $27.8 Billion |

| TOTAL SBI AUM | $161.0 Billion |

| Note: Differentials within total amounts may occur due to rounding | |